As businesses strive for revenue growth in an increasingly competitive market, focusing on revenue operations (RevOps) has become more important than ever. Sales, marketing, and customer success need to work under a unified strategy to deliver consistent buyer experiences and drive sustainable growth.

With so many moving parts, however, how can you ensure your RevOps initiatives are on the right track? The answer lies in identifying and tracking the key performance indicators (KPIs). In this article, we’ll break down 12 essential RevOps KPIs to help you track performance, avoid vanity metrics, and zero in on what drives success.

Key Takeaways

- Revenue operations KPIs provide a comprehensive view of how well cross-functional teams collaborate to drive revenue.

- These help identify areas where you can streamline processes and optimize resources to enhance overall efficiency.

- Metrics like adoption rate and customer lifetime value provide valuable data for anticipating future revenue streams, making informed strategic decisions, and driving sustainable growth.

What Are Revenue Operations KPIs?

Revenue operations KPIs are key metrics used to assess the effectiveness and efficiency of an organization’s revenue-generating processes in a specific period. Beyond just showing total revenue, these KPIs provide insights into how well your business performs with conversion rate, sales velocity, speeding up sales processes, and maintaining customer loyalty. They give you a clear picture of what’s working and where there might be room for improvement.

Why Are Revenue Operations KPIs Important?

KPIs are essential for driving business growth and alignment. They link your strategies to tangible, measurable results and provide insights into whether you’re hitting your targets. This allows you to make data-driven decisions to amp up your company’s revenue-generating capabilities.

For instance, if acquiring a new customer is too expensive, you can evaluate the ROI of marketing campaigns, reassess the sales process, and explore more cost-effective acquisition channels. You can also track the sales cycle length to identify bottlenecks, streamline workflows and introduce automation to speed up deal closure.

On top of that, benchmarking KPIs against industry standards or competitors gives you a valuable perspective on where your company stands in the market. Understanding how your performance stacks up against industry leaders allows you to identify revenue operations best practices, adapt successful strategies, and set more realistic goals that drive competitive advantage.

Revenue Operations Metrics vs Sales Metrics

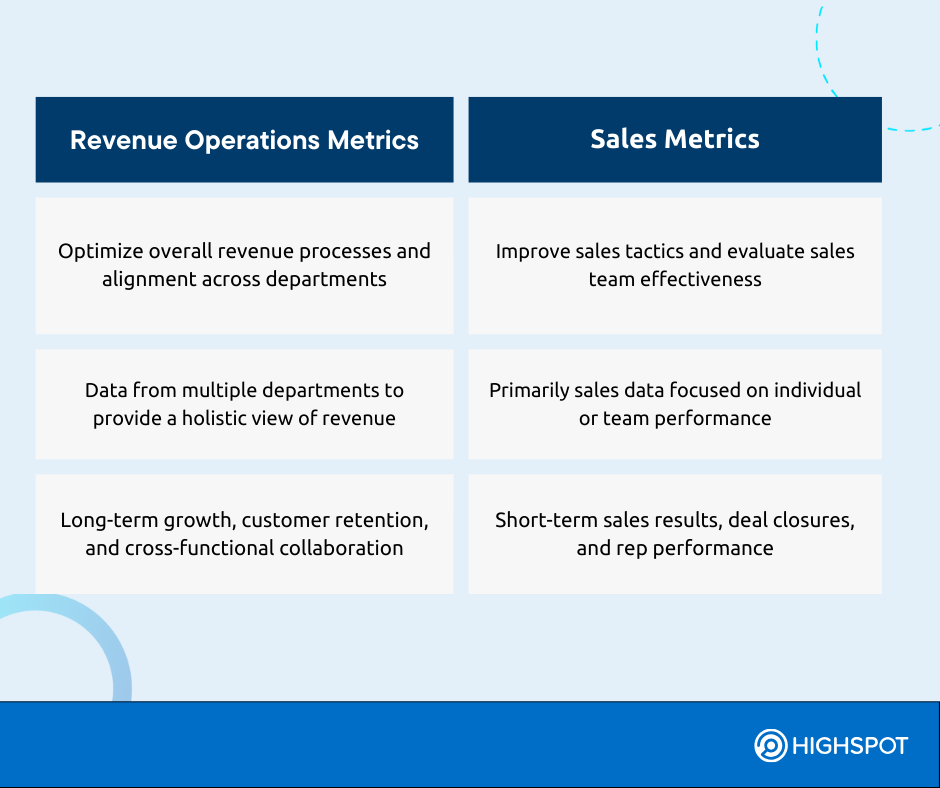

Although there’s an overlap between RevOps and sales metrics, they serve distinct purposes. RevOps metrics focus on the bigger picture, looking at overall business performance, team alignment, and long-term customer relationships. In contrast, sales metrics zero in on individual sales performance, like quota attainment. They track specific sales team activities and sales rep performance within the broader revenue strategy.

12 Revenue Operations KPIs Every Team Needs to Track

RevOps ties together every aspect of revenue generation, from sales and marketing to customer success. This means it tracks more KPIs than any other part of your business. Here are 12 KPIs to gauge RevOps team performance.

1. Annual Recurring Revenue (ARR)

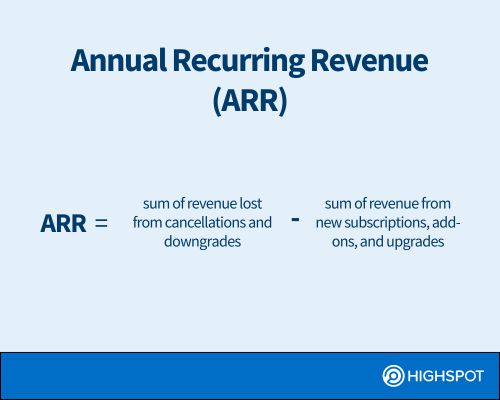

ARR, or annual recurring revenue, is a common metric used by SaaS-based businesses, especially technology vendors. This can also be calculated as monthly recurring revenue (MRR).

ARR represents the amount of revenue that will come in annually for the life of the subscription or contract. This metric is recognized as a very important measurement for revenue operations professionals, with 51.3% of them emphasizing its importance for engaging leadership. This is no surprise since ARR is predictable revenue.

For example, if you have 100 customers, each paying $1,000 annually, your ARR is $100,000.

Calculation: ARR = (sum of revenue from new subscriptions, add-ons, and upgrades) – (sum of revenue lost from cancellations and downgrades)

2. Conversion Rate

The conversion rate lets you know the percentage of your leads that turn into customers. If you have 200 leads and 5 become customers, your conversion rate is 2.5%. The optimal conversion rate varies by industry.

At first glance, this figure won’t reveal much. It doesn’t indicate whether your pricing is off, your product demo needs improvement, a mix of both, or something else. Revenue operations analyzes the performance of your sales and marketing efforts, getting to the root of the problem and providing a solution.

Calculation: Conversion Rate = (Number of conversions/number of leads) x 100

3. Customer Lifetime Value (CLV)

CLV estimates the total customer revenue you can expect over their lifetime. This helps you make the most of each existing customer rather than focusing solely on acquiring new ones, which is more expensive. Knowing their average value gives you the opportunity to increase revenue through upselling, cross-selling, or renewal.

For example, if a customer spends $10,000 per purchase, buys twice a year, and stays for five years, their CLV is $100,000.

Calculation: CLV = Average Order Value x Purchase Frequency Rate x Average Customer Lifespan

4. Sales Pipeline Velocity

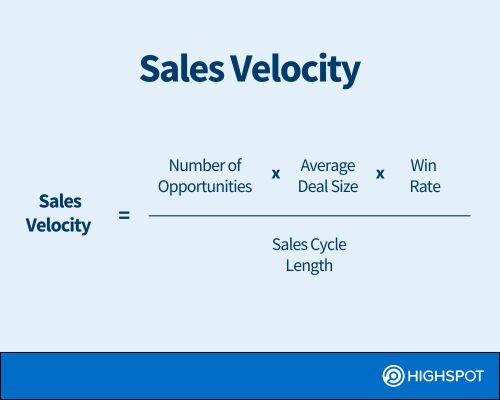

Sales velocity shows how quickly sales opportunities move through the sales pipeline and result in closed deals. A higher sales velocity means you have successful sales strategies, high-quality leads, and efficient sales processes. The ‘health’ of sales velocity is dependent on the type of product or service your sales team is selling.

If you aim to move leads faster through the sales funnel, consider running A/B tests on marketing content to find out what works best. Find ways to streamline your sales operations and improve customer service.

Calculation: Sales Velocity = (Number of Opportunities x Deal Size x Win Rate) / Sales Cycle Length

5. Customer Churn

The customer churn rate tracks the percentage of customers who stop doing business with you for any reason. The lower this number, the better. A lower churn rate signals higher customer satisfaction and retention. On the flip side, a high churn rate might point to a poor onboarding process, ineffective loyalty programs, or better alternatives from competitors.

Calculation: Customer Churn Rate = (Customers lost during a period / Total customers at the start of the period) x 100

6. Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) refers to the total cost involved in acquiring a new customer. This encompasses sales and marketing expenses, property, equipment, and human resources.

CAC allows for smarter decision-making by providing insights into the revenue your company gains from new customers and how long it takes to recoup the costs of acquiring a customer and start making a profit.

For instance, if you spent $100,000 on marketing and sales and acquired 100 new customers, your CAC would be $1,000.

Calculation: CAC = Total Sales and Marketing Costs / Number of New Customers Acquired

7. Win Rate

Win rate tracks how many sales opportunities turn into actual sales. It reflects how well your sales team is doing, showing where they shine and where they might need to step up their game.

For example, if you closed 20 out of 50 deals, your win rate is 40%.

Calculation: Win Rate = (Number of Deals Won / Total Number of Deals) x 100

8. Net Revenue Retention (NRR)

NRR captures every shift in recurring revenue, factoring in upsells and churn. It gives you a full picture of how your revenue evolves over time, showing how effectively you’re retaining customers and growing revenue. This also helps you understand why customers quit using your products or services.

According to Bain & Company, a 5% increase in customer retention can boost profits by over 25%. Your loyal customers will typically buy more over time. Plus, happy customers often refer others and are willing to pay a higher rate to stick with a company they trust rather than switching to a less familiar competitor. This reduces your operating costs.

Calculation: NRR = [(Revenue at start + Expansion Revenue – Churned Revenue) / Revenue at start] x 100

9. Average Deal Size

The average deal size is the average value of each closed deal. Knowing this will help you understand the financial impact of your sales efforts. Upselling, cross-selling, and value-based selling can help increase the average deal size.

Calculation: Average Deal Size = Total Revenue from Deals / Number of Deals Closed

10. Adoption Rate

The adoption rate measures how frequently customers use your product or service after signing up and highlights which features are most popular. High adoption rates indicate that your solution is a success and that customers see value. It also helps refine your sales forecasting by providing insights into customer engagement.

Calculation: Adoption Rate = (Number of Users Adopting Product / Total Number of Users) x 100

11. Net Promoter Score

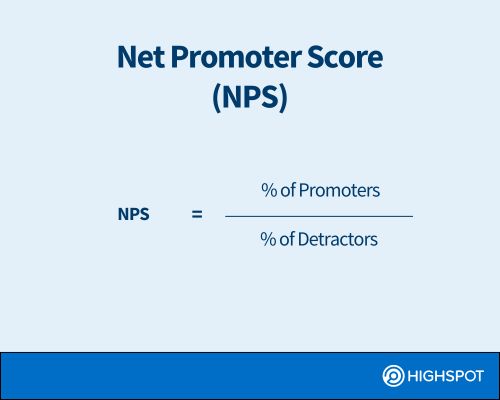

NPS can help you gauge loyalty and satisfaction by measuring how likely customers are to recommend your product or service to others. This can guide your strategy for product development, customer service improvements, and overall revenue growth.

Based on their answers, customers fall into three categories:

- Promoters (9-10): Enthusiastic supporters who are likely to promote your brand.

- Passives (7-8): Satisfied but not particularly enthusiastic customers.

- Detractors (0-6): Unhappy customers who might discourage others from using your product or service.

From there, you can calculate the percentage of promoters and detractors:

- Percentage of Promoters: (Number of Promoters / Total Number of Respondents) × 100

- Percentage of Detractors: (Number of Detractors / Total Number of Respondents) × 100

Then, apply the formula for NPS:

NPS = Percentage of Promoters − Percentage of Detractors

12. Net New Growth

Net new growth reveals how much additional revenue you’re bringing in from new customer deals beyond your existing base. It measures the difference between the revenue from new customers and any revenue lost from customers who leave. It indicates how well your business is expanding.

Calculation: Net New Growth = (New Revenue – Revenue Lost to Churn) / Revenue at Start of Period

Aligning Revenue Operations KPIs with Business Goals

Getting a new revenue operations initiative up and running is no small feat, and how you measure it is just one step in proving success or failure. Don’t waste time on irrelevant metrics. Instead, focus on those that show ROI and demonstrate the value of your hard work.

Here’s how to get started:

Identify Your North Star

A North Star metric is a measurable KPI that is a reference point that keeps your team focused. For example, if your North Star is to be number one in your industry for customer experience, your KPI might be achieving the highest net promoter score (NPS).

Set SMART Goals

Work with the sales, customer success, marketing teams, and stakeholders to define Specific, Measurable, Achievable, Relevant, and Time-bound goals that support your revenue objectives. A SMART goal could be to increase annual recurring revenue (ARR) by 20% within the next 12 months by improving customer retention and upsell strategies. This goal is:

- Specific (increase ARR)

- Measurable (by 20%)

- Achievable (with retention and upsell)

- Relevant (supports revenue growth)

- Time-bound (within 12 months)

Align Sales, Marketing, and Customer Success Teams to Revenue Goals

This will get all teams working towards the same revenue targets. For example, if your revenue goal is to increase customer lifetime value (CLV), sales might focus on upsells, marketing targets high-value leads, and customer success works on retention strategies. When these teams align their efforts, the unified approach maximizes revenue potential.

A comprehensive sales enablement platform can further support this alignment by providing a centralized hub for tracking KPIs, sharing insights, and coordinating efforts across teams. This ensures that everyone has the information they need to execute their strategies effectively.

Identify Relevant KPIs

Focus on the KPIs that matter for your specific goals, cutting through the noise to track what’s most impactful. While some metrics are standard across companies, focus on those that reflect your unique organization.

Remember, KPIs should evolve as your revenue operations strategy and the market change. For example, if you focus on long-term customer relationships, a KPI like customer lifetime value (CLV) would be more appropriate than tracking lead generation numbers.

Measure, Analyze, Optimize

Regularly measure your KPIs, analyze the results, and adjust to keep RevOps on track. To do this, set up a routine for reviewing weekly, monthly, or quarterly KPI data, depending on your business cycle. Use dashboards to visualize real-time trends and identify improvement opportunities. You can even test new strategies and monitor dashboard changes. For example, if you notice a drop in sales velocity, analyze the sales process, identify bottlenecks, and implement sales enablement, onboarding, and training to fix the performance problem.

Conclusion

Revenue operations has unified the traditionally siloed way of managing data and systems by integrating go-to-market teams. As RevOps continues to evolve, aligning teams and measurements around the customer journey ensures that every touchpoint is optimized for growth and retention.

Looking ahead, the importance of AI-powered smart KPIs cannot be overstated. According to recent research, of the 34% of organizations surveyed that use AI to create new KPIs, 90% see improvements. These smarter KPIs enhance informed decisions and uncover new opportunities for differentiation.

Highspot’s AI-powered sales enablement platform can help you tie every engagement to revenue. Request a Highspot demo today!